Outstanding Info About How To Lower Mortgage Principal

Make one extra payment every year.

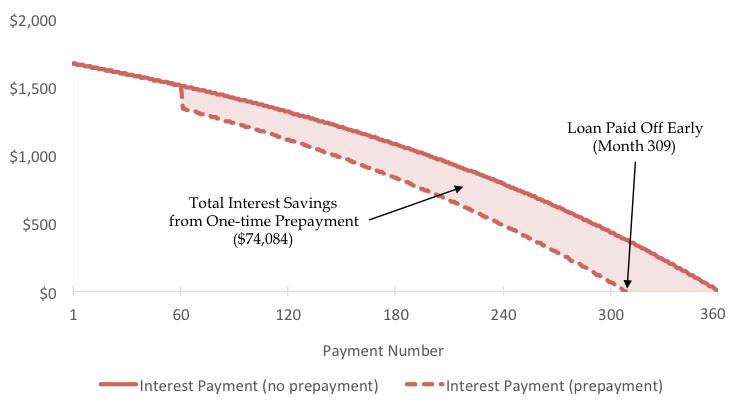

How to lower mortgage principal. To calculate your mortgage principal, simply subtract your down payment from your home’s final selling price. Making just one extra payment towards the principal of your mortgage a year can help take years off. Increase your contribution by $1 each month.

Make sure paying these costs makes financial sense for you. Recasting your loan involves applying a large lump sum payment to your loan principal and. Keep in mind, though, that any extra amount paid to reduce your principal balance can knock years off your mortgage term.

C = the period interest rate, which consits of dividing the apr as a decimal by the frequency of payments. Extend the length of your mortgage. There are a number of ways to shorten your loan term and save a ton of money in interest on your mortgage.

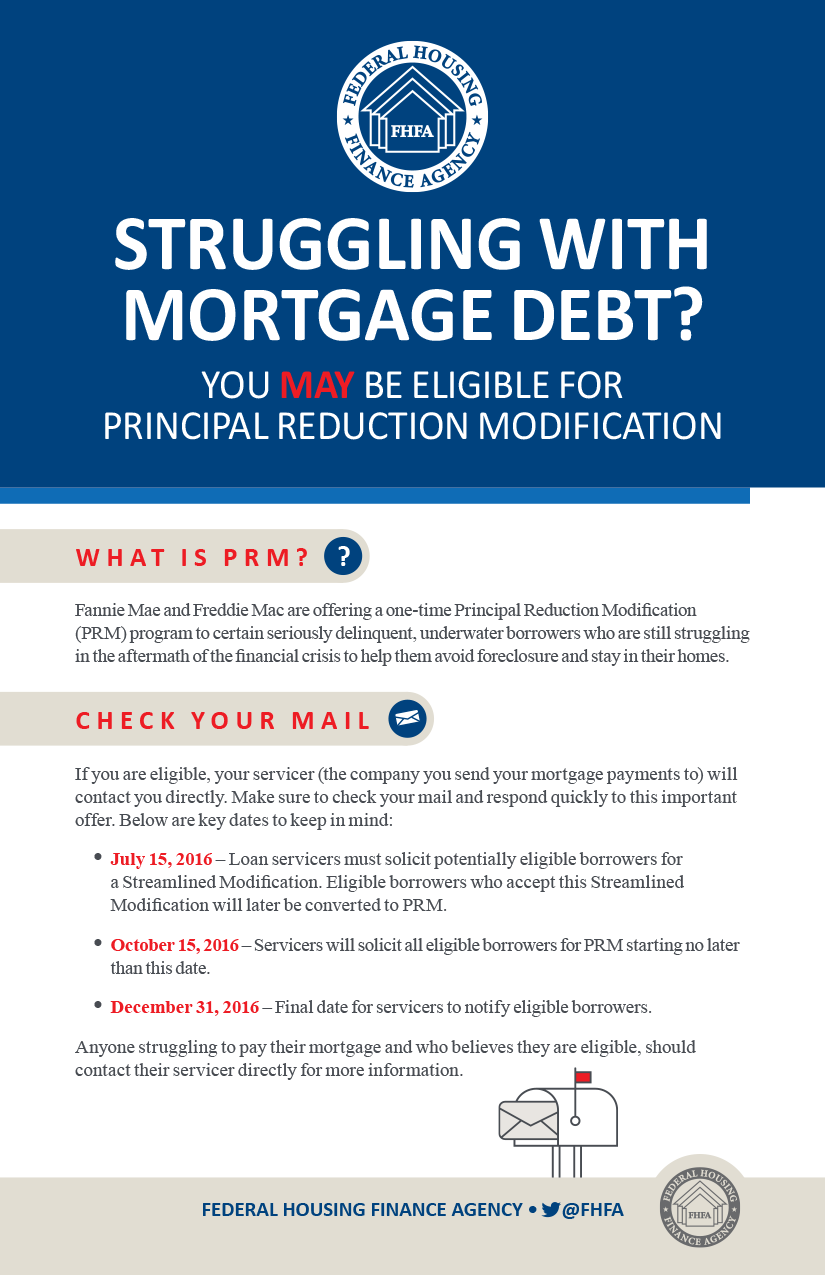

L = the loan value. Take advantage of the government gse's mortgage relief product before it's too late. Recasting your mortgage if you're ahead on your mortgage and want to lower your monthly payment, one underrated option is to simply recast your mortgage.

You might cut the length of your mortgage by eight years if you. Simple interest is based on your mortgage principal, or the total amount of money borrowed, and can be calculated with this formula: Can i lower my mortgage payment without refinancing?

The mortgage principal reduction program employs a simple and effective formula to calculate an affordable payment for the homeowner based; Here are five of the easiest ways to lower your mortgage payment, some of which can lead to considerable savings over the long term. Ad if you owe less than $420,680, take advantage of a generous mortgage relief program & refi.

:max_bytes(150000):strip_icc()/dotdash-INV-final-Ways-to-Be-Mortgage-Free-Faster-Apr-2021-02-d54b2295a00646f5b046571b0f099aad.jpg)

/what-is-an-interest-only-mortgage-1798407_final-10a5780f439a49cc936bb05486099dd1.jpg)

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)