Awesome Tips About How To Lower Dso

Lowering your dso doesn’t have to be difficult.

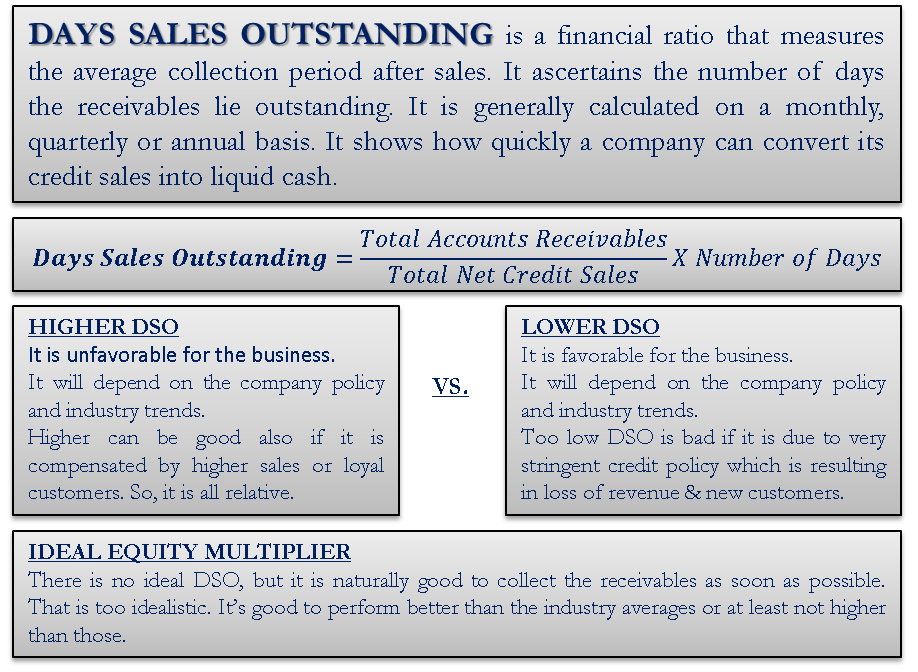

How to lower dso. It’s almost impossible to reduce dso with having slow manual processes in place. Days sales outstanding (dso) represents the average number of days it takes credit sales to be converted into cash, or how long it takes a. One of the most effective ways to quickly lower your dso is to perform stricter credit evaluations, particularly on problematic and new customers.

There are several ways to reduce dso, which are: To help you get started, here are four top tips: Here ten ways that you can lower your days.

Offering incentives for prompt payment offering incentives for early payments accelerate the payment process, as discounts. You can't manage what you can't measure. Here are our tips to get your firm closer to shorter dso:

With every sale put on credit, there’s an outstanding balance,. There are several things that. Reduce days sales outstanding (dso) to improve your cash flow.

We prefer to use the term “control your dso” rather than “lower your dso.” having full control over that number is critical. Invoicing is at the heart of every business. The dso is a crucial number to monitor, because a small change in the figure can make a significant difference to your cash flow.

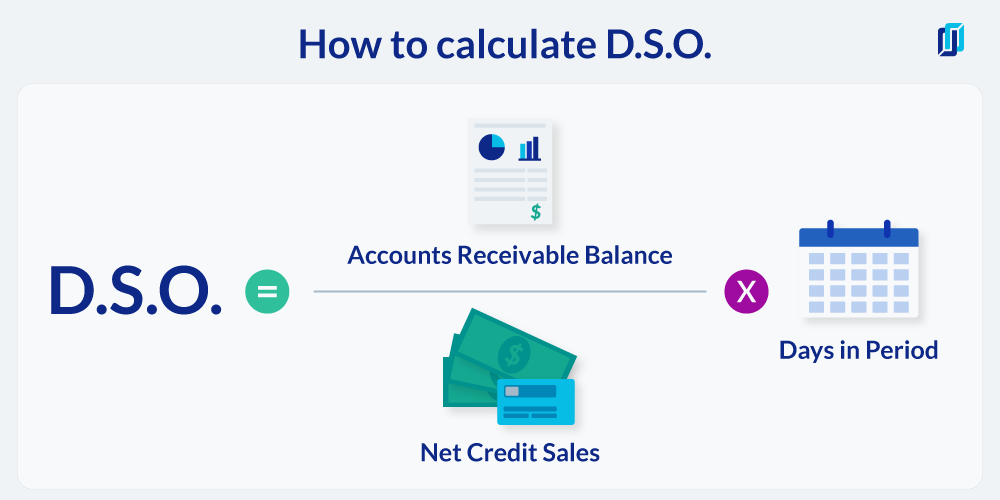

Decline payments via credit (or offer incentives such as discounts for. The dso calculation formula = (total accounts receivable / total credit sales) x number of days. It’s an effective way to create more liquidity for your business.