Supreme Tips About How To Avoid Debt

Ad financial relief with americor funding.

How to avoid debt. Moreover, you can occasionally reduce your debt by using your. Only buy items you can pay for in full. Well, with credit cards, one thing that you want to do is make sure you make those minimum payments.

Cut debt by 50% or more. Ad explore debt relief benefits with accredited debt relief. Avoid bankruptcy and revive your credit!

Americor will find the best solution for you. In most cases, you can avoid debt by managing your resources wisely. One of the most effective ways to avoid debt is to only.

If you do incur debt, such as a. Much like how you track your personal expenses, have a dedicated file/planner/document for your. The first step to avoid a debt trap is by clearing your credit card bills and loan emis on time and in full.

As a part of knowing how to avoid debt, you must learn to avoid racking up credit card debt. Discipline yourself in your purchases, avoiding debt to the extent you can. We encourage people to always pay more than the minimum.

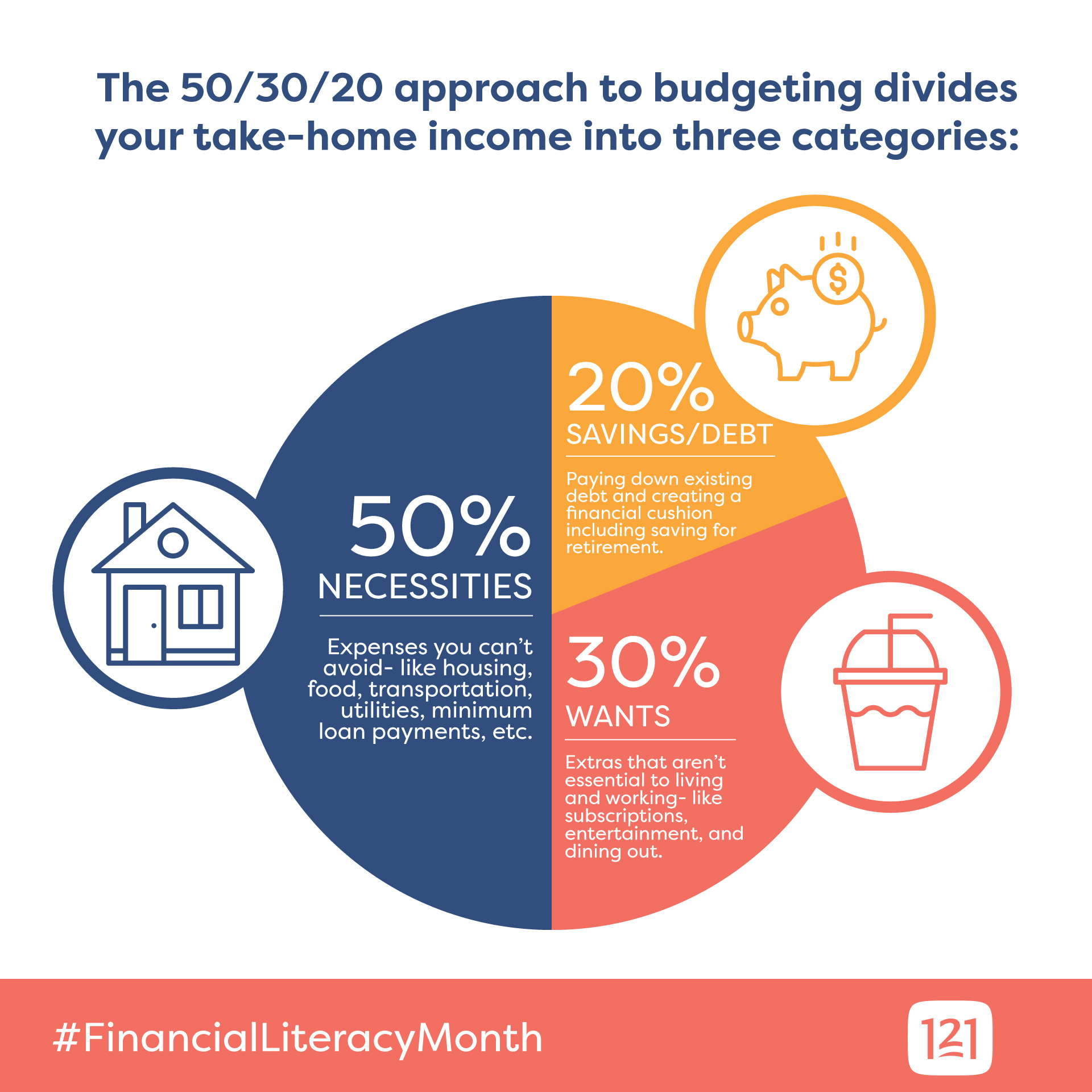

The most important way for how to avoid debt is to live within your means. In the words of our editor, “excel file is the key to a happy marriage.”. Accc offers seven tips on how to avoid debt: